Northwest Bank takes pride in its team of dedicated professionals who work together to support area employers and their employees with financial andbenefit solutions to meet their needs. Shown above are, from left: Treasury Management Advisor Jennifer Stewart, Regional Commercial Market Executive Anita Kuchcinski, Employee Benefits Manager Denny Fortin, CPFA, Regional Commercial Relationship Manager Katie Ruffa and District Manager Kregg Heenan.

Ryan Brosius, CPA, understands the value of banking with the right partner. As chief financial officer at Wavepoint 3PL, Inc. in North East, Pennsylvania, Brosius has worked with Northwest Bank to finance Wavepoint’s large real estate purchases as well as annual capital expenditures. The bank has provided creative financing solutions with competitive rates.

Brosius calls the Northwest team a “trusted advisor” that has continued to scale as the hybrid, third-party logistics company has grown.

“Northwest has provided excellent customer service from commercial lending and underwriting to treasury management, retirement and branch operations,” Brosius says. “Their team is professional, available and interested in understanding our business.”

As a large commercial borrower, Wavepoint 3PL in North East, Pennsylvania, has looked to Northwest Bank for a variety of services, from commercial lending to treasury management, retirement and branch operations. Shown here, from left are: Nick Schrader, executive vice president of Wavepoint 3PL, Inc.; Northwest Regional Commercial Relationship Manager Katie Ruffa; Kirk Hill, president of Wavepoint 3PL, Inc.; and Ryan Brosius, chief financial officer of Wavepoint 3PL, Inc.

“We have been proud to partner with Wavepoint as they have continued to expand and provide innovative, best-in-class supply chain solutions for their clients. We look forward to tailoring our products and services to grow with them well into the future,” says Northwest Bank Regional Commercial Relationship Manager Katie Ruffa.

At a time when personalized services and tailored solutions are paramount for employers, Northwest has taken a collaborative approach to banking and benefits.

“Once they’re here at Northwest, we can help them as their business grows in any direction,” explains Anita Kuchcinski, regional commercial market executive. “We have the ability to support them as a small startup business — providing the people and the capabilities as they advance — to a larger business banking customer or a corporate customer. We foster the relationship along the way.”

TAILORED SOLUTIONS

Northwest takes pride in its team of dedicated professionals who work cohesively to support businesses at every stage of their journey. Whether it’s a startup seeking capital infusion or an established employer looking to optimize its financial strategy, Northwest’s team of experts comes together to offer insights, guidance and innovative solutions tailored to each client’s goals.

As district manager for 11 of 12 Northwest bank branches in Erie County, Kregg Heenan works on the Main Street side of Northwest’s business portfolio, providing banking services for business customers up to $5 million in revenue. “From the branch side, we’re really helping our businesses with cashflow in terms of line of credit protection, navigating the ups and downs of their business cycle,” he says.

In today’s fast-paced business landscape, however, one size rarely fits all. Northwest understands the diverse needs and challenges faced by businesses across various industries. Leveraging its team- centric approach, the bank offers customized solutions that address the specific requirements of each client. From financing for expansion projects, cash management solutions to streamline operations or risk management strategies to mitigate uncertainties, Northwest collaborates closely with businesses to develop tailored financial solutions that align with their goals and objectives.

“In my opinion,” Heenan continues, “customers choose Northwest because I think we’re able to provide large bank services and capabilities, but also deliver that in a personal hometown touch.”

PERSONALIZED SERVICES

One of the cornerstones of Northwest’s unique approach is the personalized services it provides to employers — and their employees — to help them realize their financial goals.

“A critical part of any business is making sure employees are financially happy, because the happier an employee is, the better and more productive they are at work,” says Heenan. “We hope to be the first point of contact, but then be able to bring in the team to help the business grow and to help their employees in their personal lives.”

Northwest Employee Benefits Manager Denny Fortin, CPFA, meets regularly with employers to help establish and guide employees through retirement plans. “When we work with a company, we bring our experience and our knowledge in and try and make sure that their retirement plan, whether it’s a 401(k), a pension or a 403(b), is accomplishing their goal,” he says. “We’re able to look at how it’s designed and how it works and make suggestions and keep up to date with current regulations that are going on and keep ahead of that curve.”

Northwest is also able to assist with non-qualified plans, which benefit key people within the company. “The question for the owner is, ‘What are you trying to accomplish?’ ” explains Fortin. “Because we want to figure out what the best situation is.”

Northwest’s Trust Department works with business owners on succession and estate planning as well. “Finding a qualified buyer is not easy right now,” notes Kuchcinski. “It doesn’t matter the size of company — small, medium, large. Being able to get the amount of money that you’re going to need to retire is not happening for a lot of people at this point and that’s an important conversation to have.”

TECHNOLOGY AND FRAUD PREVENTION

For business customers, Northwest Bank complements its personalized services with enhanced technology and services that improve the customer experience and minimize risk.

For instance, Northwest’s Treasury Management Services helps customers address collection and payments by utilizing credit cards and ACH (automated clearing house) service for faster payments that are more secure.

Fraud protection is also becoming an increasingly important role in banking today with fraud cases tripling each year. As a result, Northwest continues to grow its fraud team by a minimum 20 percent annually.

According to Treasury Management Advisor Jennifer Stewart, “It doesn’t matter if you’re a small business, a large business or in between. Fraud can happen to you individually and it can happen to you through your business. We go out and we’ll talk to businesses about how to protect yourself.”

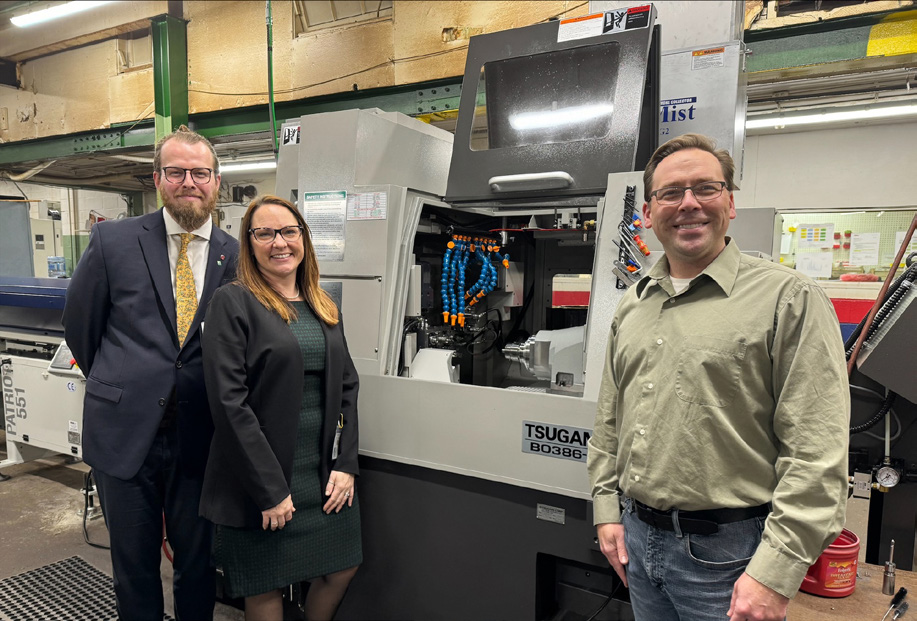

Jon Kirk, owner and president of Kirk Precision Machining in Lake City, Pennsylvania, utilizes Northwest services now after his business became the target of a fraudulent check scheme. In 2023, three men had been stealing checks from the mailboxes of various Erie-area businesses, including Kirk’s, and attempting to alter and cash them at various banks. A Northwest Bank teller in Union City noticed the large amount for $3,800 and contacted Kirk immediately. Police eventually caught the suspects, and Kirk was able to reverse the transactions for four stolen checks, totaling nearly $16,000 — a potentially big hit to the cashflow of a small business that was just a year and a half old.

“After the fraud case, they helped me set up electronic notifications and reports about what was moving from our account,” says Kirk. “They’ve been very

proactive about helping me when it comes to growing the business.”

A COMMUNITY PARTNER

Beyond its role as a financial service provider and advisor, Northwest Bank is deeply ingrained in the fabric of the communities it serves. Through philanthropic initiatives, volunteer programs and civic engagements, the bank and its team members not only support their customers but the well-being of the region as well.

“We are only as good as the communities we live in,” adds Kuchcinski. “It takes all of us to make those communities better. That’s not just by providing a full circle of bank products, but that’s going even deeper. We’re not just bankers, but partners, and in many ways, friends.”

For more information, visit northwest.bank.