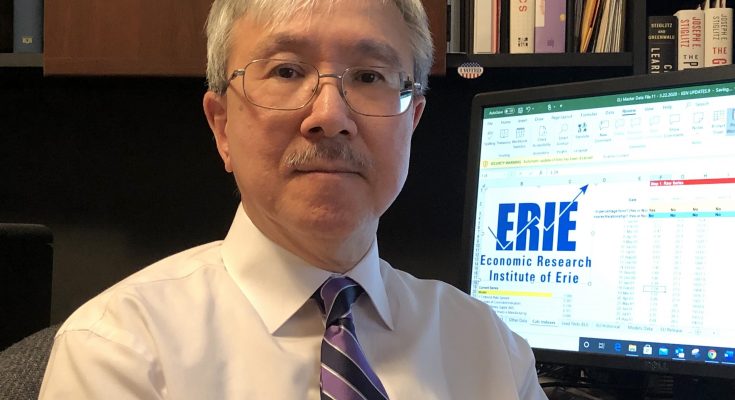

2020 has been one of the most challenging years for the employers and the economy due to the COVID-19 pandemic. Here, Ken Louie, Ph.D., director of the Economic Research Institute of Erie (ERIE) and associate professor of economics at Penn State Erie, the Behrend College, discusses the financial toll of the crisis, as well as the statistics and trends that are expected to impact the economic outlook for 2021.

COVID-19 shocked the world and has impacted nearly every business sector since the lockdown of spring, bringing an end to the longest economic expansion in U.S. history. How would you describe the outlook for the U.S. economy as we begin 2021?

The COVID-19 pandemic has certainly created a dramatic and negative economic shock, causing U.S. employment to plummet by almost 22 million in the first four months of the year and U.S. real gross domestic product (GDP) to drop by a staggering 31.4 percent in the second quarter.

But the U.S. economy is expected to resume a positive rate of growth as we head into 2021. The latest median projections by the Federal Reserve suggest that, although U.S. real GDP will contract by 3.7 percent in 2020, growth is expected to be 4 percent in 2021 before slowing down to 3 percent in 2022 and 2.5 percent in 2023.

Economists appear to be divided on when the economy will return to pre- pandemic GDP levels. What does your research show?

Economic projections generally differ across forecasting entities, and that is especially true given all the uncertainty due to the pandemic. In our research, we try to look at a wide range of prominent established forecasting sources to gauge economic trends in the U.S. economy. Although there are variations and forecasts are subject to subsequent revision based on newly available data, the latest projections seem to reflect a consensus that U.S. real GDP will grow by 3 to 4 percent in 2021.

What about the regional economic outlook? How does it compare with the state and nation for 2021?

Early indications suggest that the Erie regional economy may face a slightly more challenging situation in 2021 compared to the state and nation. For example, consumer spending, an important indicator of future economic activity, decreased by 5.9 percent in Erie County between January and early October, but decreased by only 3.2 percent in the nation as a whole and increased by 5.4 percent in Pennsylvania during the same period.

The Federal Reserve also projects the economy to improve next year, with unemployment falling to 5.5 percent by the end of 2021. What is your assessment of the employment rate?

We are recovering some of the pandemic-related job losses. However, the pace of job recovery in the Erie economy has been slower than that in the state and nation. As of September, Erie has recovered only 44 percent of the jobs lost during the early months of the pandemic, while Pennsylvania has recovered 55 percent, and the U.S. has recovered 52 percent. Although it has been falling gradually and may continue to do so in 2021, Erie’s unemployment rate of 11.2 percent (as of August) is still higher than that in the state and nation.

COVID-19 continues to impact the business sector in new ways, creating emerging industries and unfortunate closures. Which sectors are rebounding better than others?

Among the sectors that have suffered the biggest job losses in Erie, those that have rebounded at the fastest pace are Leisure and Hospitality; Mining, Logging, and Construction; Retail Trade; and Professional and Business Services. However, except for Mining, Logging, and Construction, employment in the other sectors is still below pre-pandemic levels. Job growth in the manufacturing sector has been relatively slower and more erratic.

According to a recent Chief Executive survey, America’s CEOs report to be increasingly confident that the worst of the COVID-19 crisis is behind us, sparking optimism for 2021. But much of this confidence is built on two uncertainties: a COVID vaccine and the presidential election. How critical are these two variables to our economic recovery?

These two elements will indeed play critical roles in influencing our economic recovery. A safe and effective COVID vaccine that is widely accepted by the general public may increase the likelihood that the economy will be able to restore the higher levels of production, employment and income that can enhance our economic prosperity. And the outcome of the presidential election will determine the future course of government policies that affect the economy.

What key areas/current issues should we be keeping our eyes on when it comes to the economic forecast for 2021?

I think a key metric to watch is whether the pace of U.S. job recovery will pick up as we head into the new year. A faster rate of employment growth will indicate that businesses are expanding production at a higher rate, which will generate higher levels of household income. It also will be important to watch indicators of business, investor and consumer confidence, since this will affect investment and consumption decisions that will in turn influence the course of the economic recovery.

Finally, we also need to be attentive to COVID-19’s economic and social impact in other countries across the world, since global events may also affect U.S. economic performance.

In the United States, economic stimulus has been used to combat the pandemic and economic pain it’s inflicted. What do you believe is the impact of this debt going forward?

According to the Congressional Budget Office, U.S. federal debt held by the public is projected to equal 98 percent of GDP by the end of 2020 and reach 107 percent of GDP by 2025. In the long run, such high levels of federal debt may pose financial risks, so it’s important that we try to devise a long-term strategy that will gradually reduce the size of the debt.

However, with an ongoing pandemic that has caused so much unanticipated economic hardship for so many workers and their employers, I think the more important short-run imperative is to continue to provide financial assistance where it is needed. This is especially true in light of the current low-interest environment, which effectively reduces the cost of servicing the debt.

In your opinion, what is the most important economic lesson that we’ve learned from the COVID-19 crisis and why?

The most important economic lesson is that a relatively stable and robust economy can be devastatingly disrupted by sudden and unexpected non- economic forces. A corollary is that, going forward, we should strive to build elements of resilience into all parts of our economy and society so that we will be much better able to withstand any future negative shocks to the system.